http://frankwest.myhomehq.biz/single-newsletter/why-life-insurance-is-important-for-everyone

Health, Medicare, Group Medical, Life & Dental Quotes

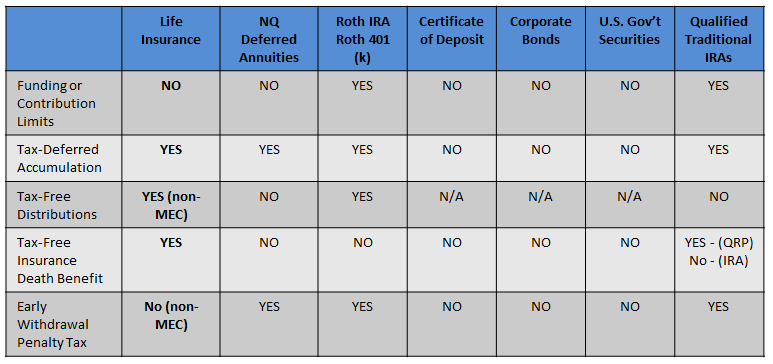

Top 6 Tax Benefits of Life Insurance:

You can’t pinpoint the ideal amount of life insurance you should buy down to the penny. But you can make a sound estimate if you consider your current financial situation and imagine what your loved ones will need in the coming years.

In general, you should find your ideal life insurance policy amount by calculating your long-term financial obligations and then subtracting your assets. The remainder is the gap that life insurance will have to fill. But it can be difficult to know what to include in your calculations, so there are several widely circulated rules of thumb meant to help you decide the right coverage amount. Let’s look at a few of them.

“It’s not a bad rule, but based on our economy today and interest rates, it’s an outdated rule,” says Marvin Feldman, president and CEO of insurance industry group Life Happens.

The “10 times income” rule doesn’t take a detailed look at your family’s needs, nor does it take into account your savings or existing life insurance policies. And it doesn’t provide a coverage amount for stay-at-home parents.

Both parents should be insured, Feldman says. That’s because the value provided by the stay-at-home parent needs to be replaced if he or she dies. At a bare minimum, the remaining parent would have to pay someone to provide the services, such as child care, that the stay-at-home parent provided for free.

Education expenses are an important component of your life insurance calculation if you have kids. This formula adds another layer to the “10 times income” rule, but it still doesn’t take a deep look at all of your family’s needs, assets or any life insurance coverage already in place.

This formula encourages you to take a more detailed look at your finances than the other two. DIME stands for debt, income, mortgage and education, four areas that you should consider when calculating your life insurance needs.

Debt and final expenses: Add up your debts, other than your mortgage, plus an estimate of your funeral expenses.

Income: Decide for how many years your family would need support, and multiply your annual income by that number. The multiplier might be the number of years before your youngest child graduates from high school.

Mortgage: Calculate the amount you need to pay off your mortgage.

Education: Estimate the cost of sending your kids to college.

The formula is more comprehensive, but it doesn’t account for the life insurance coverage and savings you already have, and it doesn’t consider the unpaid contributions a stay-at-home parent makes.

Follow this general philosophy to find your own target coverage amount: financial obligations minus liquid assets.

To illustrate, let’s look at a fictional couple: Jason and Heather. They have two children, ages two and five. Jason makes $75,000 a year, and Heather is a full-time stay-at-home mom. They have a $150,000 balance on their home mortgage, owe $16,000 on two car loans and have $3,000 in credit card debt.

Jason has group life insurance equal to double his annual salary, and Heather has none. Together, they have $20,000 in a savings account and $10,000 in their kids’ college funds.

The couple decide that they want 30-year term life insurance policies. By the end of the term, their children will be adults, their mortgage will be paid off, and, if they stick to a savings plan, the remaining spouse will have a retirement nest egg.

To calculate his life insurance needs, Jason would add his obligations:

This totals $1,576,000. From this, Jason would subtract:

This means that Jason should buy a $1.4 million ($1,396,000) term policy.

Here’s how a calculation would work for Heather. Her obligations would include:

This totals $476,000. From this, she would subtract $30,000 to account for the couple’s savings and their kids’ college funds. Her final estimated life insurance need is $450,000 ($446,000).

Heather might also want to figure income replacement into her policy, says Johanna Fox Turner, a partner of Milestones Financial Planning and president of Fox & Co. CPAs, Inc., in Mayfield, Kentucky. She notes that the surviving parent might want to quit work to take care of the kids for a few years — in which case, the stay-at-home parent’s policy should include income replacement, rather than child care costs, for those years.

Sad though your death would be, it’s unlikely it would create financial hardship for anyone. Any honest financial assessment of your situation would have to conclude that you have little or no need for life insurance. An argument could be made that you should buy a policy now while you’re young and rates are low. And if someone — a parent, say — depends on you for financial support, then by all means, consider life insurance. But consider the interest you could earn by saving and investing your money instead of spending it on insurance premiums. Still, if somebody — a parent, a grandparent — wants to buy you a policy now to lock in low rates for later in your life, accept it gratefully.

Love and marriage

Married couples with no children may need little or no life insurance, especially if both spouses contribute equally to the household income.

The death of either spouse would not be financially catastrophic; the other could presumably survive on his or her own income. Still, it could be a strain. Perhaps the survivor couldn’t afford the mortgage or rent payments on a single income, or maybe you have big credit card debts. Also, there would be funeral costs.Each of you should probably buy a modest amount of life insurance to protect the other.

A one-income family with young children is the classic high-need situation. Basically, all of these people are dependent on one breadwinner for their total support , so insurance on that life is vital. And if the nonearning spouse should die, the other would have to pay for child care — a very expensive proposition that argues for insurance on both lives. This same high-need situation exists for dual-income households with children, for single parents, and for those caring for elderly parents who have limited resources of their own

The kids have grown and are making it on their own. You have a pension and considerable assets that can be used to generate a good income after you die. In circumstances like this, you clearly don’t need as much life insurance as you once did.

The one caveat here is estate planning. If your estate is large enough to be subject to the estate-tax when you die, your heirs can use the death benefit to pay the IRS. If the policy is held by a trust, the benefit would not be counted as part of your estate.

If you fall into this category, consider a whole life policy. Since you don’t know when you will die, you’ll need to hold on to your coverage indefinitely.

https://www.lifehappens.org/videos/a-life-lived-fully-but-wisely/

https://www.lifehappens.org/videos/life-happens-in-a-heartbeat-30-second

https://www.lifehappens.org/videos/never-miss-a-moment

Copyright © 2025 · Genesis Framework · WordPress · Log in

|

Frank West Insurance Services | Individual Health Insurance, Family Health Insurance, HTH Travel Insurance, CA Medical Insurance, Affordable San Diego Health Insurance, Insurance Quotes, Whole & Term Life Insurance Policies, Medicare Supplement Insurance, Medigap Plans, San Diego Medical Insurance, Medical Coverage, Health Care Reform & Affordable Care Act Assistance, CA Health Insurance Exchange, Group Health Insurance, Business Health Plans, Health Care Insurance, Long Term Care, Group Health Insurance, Employee Benefits, Dental Insurance, Disability Insurance, San Diego Life Insurance, Anthem Blue Cross, Aetna, Blue Shield of CA, Cigna, Health Net, Kaiser Permanente, San Diego, Coronado, La Jolla, Pacific Beach, Rancho Penasquitos, Poway, Rancho Bernardo, Oceanside, Solano Beach, Pacific Beach, Cardiff-by-the-Sea, Encinitas, Carlsbad, Carmel Valley, Del Mar, Olivenhain, Rancho Santa Fe, Aviara, Lakeside, |