http://www.benefitspro.com/2017/06/26/americans-arent-buying-life-insurance-but-why

Americans aren’t buying life insurance, but why?

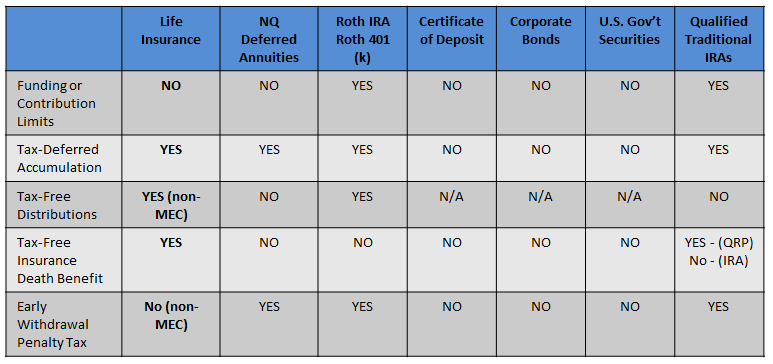

Tax Advantages of Life Insurance.

Top 6 Tax Benefits of Life Insurance:

- Life insurance premiums are paid with after-tax dollars: Because premiums are typically not a tax-deductible expense, taxes have usually been paid on these funds and they are able to GROW tax-free.

- Tax-deferred cash value accumulation: Growth of policy cash value in excess of the cost basis are typically income tax-deferred while they remain in the policy.

- FiFO (First In First Out) tax-free distribution: For Non-Modified Endowment Life policies, cash can be withdrawn from the policy tax-free up to the adjusted cost basis.

- Tax-free death benefit: IRC Section 101(a) provides that death benefits of life insurance are income tax free when paid to the policy beneficiary.

- Not subject to 3.8% add-on tax for “passive” investment income under the Affordable Care Act (ACA).

- No deposit limits: There are no restrictions on how much can be placed in a policy versus Qualified Retirement Plan/IRA Limits (see chart below).

How Much Life Insurance Do I Need?

You can’t pinpoint the ideal amount of life insurance you should buy down to the penny. But you can make a sound estimate if you consider your current financial situation and imagine what your loved ones will need in the coming years.

In general, you should find your ideal life insurance policy amount by calculating your long-term financial obligations and then subtracting your assets. The remainder is the gap that life insurance will have to fill. But it can be difficult to know what to include in your calculations, so there are several widely circulated rules of thumb meant to help you decide the right coverage amount. Let’s look at a few of them.

Rule of thumb No. 1: Multiply your income by 10.

“It’s not a bad rule, but based on our economy today and interest rates, it’s an outdated rule,” says Marvin Feldman, president and CEO of insurance industry group Life Happens.

The “10 times income” rule doesn’t take a detailed look at your family’s needs, nor does it take into account your savings or existing life insurance policies. And it doesn’t provide a coverage amount for stay-at-home parents.

Both parents should be insured, Feldman says. That’s because the value provided by the stay-at-home parent needs to be replaced if he or she dies. At a bare minimum, the remaining parent would have to pay someone to provide the services, such as child care, that the stay-at-home parent provided for free.

Rule of thumb No. 2: Buy 10 times your income, plus $100,000 per child for college expenses

Education expenses are an important component of your life insurance calculation if you have kids. This formula adds another layer to the “10 times income” rule, but it still doesn’t take a deep look at all of your family’s needs, assets or any life insurance coverage already in place.

Rule of thumb No. 3: The DIME formula

This formula encourages you to take a more detailed look at your finances than the other two. DIME stands for debt, income, mortgage and education, four areas that you should consider when calculating your life insurance needs.

Debt and final expenses: Add up your debts, other than your mortgage, plus an estimate of your funeral expenses.

Income: Decide for how many years your family would need support, and multiply your annual income by that number. The multiplier might be the number of years before your youngest child graduates from high school.

Mortgage: Calculate the amount you need to pay off your mortgage.

Education: Estimate the cost of sending your kids to college.

The formula is more comprehensive, but it doesn’t account for the life insurance coverage and savings you already have, and it doesn’t consider the unpaid contributions a stay-at-home parent makes.

How to find your best number

Follow this general philosophy to find your own target coverage amount: financial obligations minus liquid assets.

- Calculate obligations: Add your annual salary (times the number of years that you want to replace income) + your mortgage balance + your other debts + future needs such as college and funeral costs. If you’re a stay-at-home parent, include the cost to replace the services that you provide, such as child care.

- From that, subtract liquid assets such as: savings + existing college funds + current life insurance.

To illustrate, let’s look at a fictional couple: Jason and Heather. They have two children, ages two and five. Jason makes $75,000 a year, and Heather is a full-time stay-at-home mom. They have a $150,000 balance on their home mortgage, owe $16,000 on two car loans and have $3,000 in credit card debt.

Jason has group life insurance equal to double his annual salary, and Heather has none. Together, they have $20,000 in a savings account and $10,000 in their kids’ college funds.

The couple decide that they want 30-year term life insurance policies. By the end of the term, their children will be adults, their mortgage will be paid off, and, if they stick to a savings plan, the remaining spouse will have a retirement nest egg.

To calculate his life insurance needs, Jason would add his obligations:

- $1.2 million for income replacement ($75,000 times 16, the number of years before his youngest child graduates from high school)

- $150,000 for the mortgage balance

- $19,000 for debt ($16,000 in car loans, plus $3,000 in credit card debt

- $200,000 for two childrens’ college educations

- $7,000 for final expenses — approximately the median cost of a funeral with a casket, according to the National Funeral Directors Association

This totals $1,576,000. From this, Jason would subtract:

- $20,000 in savings

- $10,000 in the kids’ college funds

- $150,000 of group life insurance

This means that Jason should buy a $1.4 million ($1,396,000) term policy.

Here’s how a calculation would work for Heather. Her obligations would include:

- $100,000 to replace the child care that she now provides, until the kids are teenagers

- $150,000 for the mortgage balance

- $19,000 for debt

- $200,000 for two children’s college educations

- $7,000 for final expenses

This totals $476,000. From this, she would subtract $30,000 to account for the couple’s savings and their kids’ college funds. Her final estimated life insurance need is $450,000 ($446,000).

Heather might also want to figure income replacement into her policy, says Johanna Fox Turner, a partner of Milestones Financial Planning and president of Fox & Co. CPAs, Inc., in Mayfield, Kentucky. She notes that the surviving parent might want to quit work to take care of the kids for a few years — in which case, the stay-at-home parent’s policy should include income replacement, rather than child care costs, for those years.

When Should You Buy Life Insurance?

When you’re single

Sad though your death would be, it’s unlikely it would create financial hardship for anyone. Any honest financial assessment of your situation would have to conclude that you have little or no need for life insurance. An argument could be made that you should buy a policy now while you’re young and rates are low. And if someone — a parent, say — depends on you for financial support, then by all means, consider life insurance. But consider the interest you could earn by saving and investing your money instead of spending it on insurance premiums. Still, if somebody — a parent, a grandparent — wants to buy you a policy now to lock in low rates for later in your life, accept it gratefully.

Love and marriage

Married couples with no children may need little or no life insurance, especially if both spouses contribute equally to the household income.

The death of either spouse would not be financially catastrophic; the other could presumably survive on his or her own income. Still, it could be a strain. Perhaps the survivor couldn’t afford the mortgage or rent payments on a single income, or maybe you have big credit card debts. Also, there would be funeral costs.Each of you should probably buy a modest amount of life insurance to protect the other.

Married with children

A one-income family with young children is the classic high-need situation. Basically, all of these people are dependent on one breadwinner for their total support , so insurance on that life is vital. And if the nonearning spouse should die, the other would have to pay for child care — a very expensive proposition that argues for insurance on both lives. This same high-need situation exists for dual-income households with children, for single parents, and for those caring for elderly parents who have limited resources of their own

The golden years

The kids have grown and are making it on their own. You have a pension and considerable assets that can be used to generate a good income after you die. In circumstances like this, you clearly don’t need as much life insurance as you once did.

The one caveat here is estate planning. If your estate is large enough to be subject to the estate-tax when you die, your heirs can use the death benefit to pay the IRS. If the policy is held by a trust, the benefit would not be counted as part of your estate.

If you fall into this category, consider a whole life policy. Since you don’t know when you will die, you’ll need to hold on to your coverage indefinitely.

Tax Free Retirement Alternatives.

<iframe src=’https://www.webprez.com/embed/player/7540/7…‘ height=’400′ width=’600′ frameborder=’0′ scrolling=’no’></iframe>

7 Myths About Life Insurance.

Life insurance is kind of like the Rodney Dangerfield of financial planning. As one of most people’s least favorite financial topics, it gets no respect. Yet, it’s something that almost everyone needs and not having it when you need it can be devastating to your family’s well being. Here are some of the most common and dangerous myths about this often misunderstood product:

1) Your employer-provided life insurance is all you need.

Your employer may provide you with life insurance equal to 1-2 times your annual salary and you may even be able to purchase up to 4-6 times your salary. But there are several problems with that. First, your “salary” doesn’t typically include commissions, bonuses, and second incomes. Second, to replace your income for dependents, you generally need at least 5-8 times your income and some experts even recommend 10-12 times. (You may want to use a calculator like this to determine your specific needs.)

Even if you do have enough insurance through your job, you may lose it when you leave. You may be able to convert your optional insurance to an individual policy or purchase one on your own but either way, it may be much more expensive than purchasing a policy today, especially if your health deteriorates.

Finally, you may actually be able to get a better deal on your own, especially if you’re young and/or in above average health. Even if your employer’s policy is initially cheaper, the cost may go up each year and you may not be able to take it with you when you leave, You can purchase an individual policy that locks in your rate for a period of time or allows you to build cash value if you want to keep the policy your whole life. Only include your employer’s coverage in covering your needs if you can take it with you at affordable rates. Otherwise, consider it a bonus.

2) Only the breadwinner needs life insurance.

“Imagine if something were to happen to the stay-at-home spouse in your family. The breadwinner may need to hire someone to clean and take care of the kids and that can cost a lot of money. Unless your family would have that extra income to spare, you may need life insurance on both spouses,” advises Marvin Feldman, President and CEO of life insurance non-profit organization, Life Happens. Insurance on the stay-at-home spouse also gives the working parent the opportunity to take time off work and help the family adjust to their loss.

3) Life insurance is really expensive.

A recent study conducted by Life Happens and LIMRA, found that 25% of Americans said they need more life insurance but only 10% planned to purchase it within the next year. The main reason given was cost, with 63% saying that it’s too expensive. However, 80% of them overestimated the cost. 25% thought that a $250k 20-year level term policy for a healthy 30-yr old would cost $1k a year or more when it actually would cost about $150.

4) My health disqualifies me from life insurance.

There are a lot of companies that cover a range of health conditions and some even specialize in high-risk cases. You can also purchase a policy that is not medically underwritten at all. Just be aware that they tend to be more expensive and have lower coverage limits.

5) Everyone should buy term and invest the difference.

While this generally makes sense for most people, a permanent policy can be a better deal if you need life insurance for your entire life. Some examples would be to provide for a special needs child or to cover estate taxes. For a small percentage of the population, the cash value can also be a good investment if you need life insurance, are in a high tax bracket and have maxed out all your other tax-advantaged options.

6) You get a better deal purchasing life insurance online.

“The Internet can be a great place to research life insurance and find an agent but you actually pay the same price whether you purchase a policy online or through a human being,” says Feldman. “What you don’t get online is the personal service that can help you figure out how much you need, which company is likely to give you the best price based on your health situation, and what the terms on the application mean. A web site may not realize that you need coverage for your whole life due to a child with special needs or that your health won’t qualify you for the rates offered by the lowest price company. Most importantly, a commission-motivated agent can help motivate you to actually get the policy as it’s something very easy to procrastinate.”

7) You’re too young to worry about life insurance.

Life insurance actually makes the most sense when you’re young since the premiums are less expensive and you have fewer assets to pass on to heirs. The longer you wait, the more expensive it will tend to be and the more likely you are to develop a medical condition that makes it much more expensive. Of course, the biggest problem with procrastinating life insurance is that by the time you need it, it’s too late to get it.

Every person’s situation is unique. Some people don’t even need insurance at all. Whatever decision you make when it comes to life insurance, just be sure it’s an informed one. After all, if something does happen to you, you don’t get to come back and relive the day like Bill Murray did in Groundhog Day.

Why Do I Need Life Insurance?

Life insurance is about how you want to live your life right now and many years from now. It’s also about how your loved ones will live their lives when you’re gone. AMAC offers life insurance products through various top-rated reputable life insurance carriers to help protect what is important to you – whether it is to protect the assets you’ve worked so hard to attain, or to ease your family’s burden after you are gone. Life insurance helps to provide peace of mind for you and your family.

To Replace Lost Income

Most people buy life insurance as a means to replace income lost if something happens to them. Providing money for survivors is important. Life insurance is the most cost effective way to do it.

To Pay Off Debt

Debt can be very burdensome to your family, especially without your income available to help repay it. Life insurance can be used to pay off debt and help create more financial security for your family.

To Pay Final Expenses and Offer an Emergency Fund

Final expenses can be very significant, especially if there are large medical bills, funeral or legal expenses to pay. An emergency fund can cover unexpected bills such as emergency repairs to your home or car. Life insurance provides cash that can be used to help your family cope in a time of distress.

To Help Pay for Your Children’s Education

Educating children can be expensive and often requires a long-term strategy. Many people plan to contribute funds each year until they have enough money saved to pay all or some of their children’s education costs. Unfortunately if something unexpectedly happens to you, there may not be enough time to set aside adequate funds for education. Life insurance can help by creating a lump-sum of cash that you can count on to help pay part of your children’s education costs.

Types of Life Insurance

Term Life: Protects your family with a death benefit for a specific term or span of years if scheduled premiums are paid. If you die during the policy term, your beneficiary is paid the coverage amount subject to your policy terms. Since it provides “pure” insurance without any cash value accumulation, term life insurance coverage is generally less expensive initially than permanent coverage.

Whole Life: Considered “permanent insurance”, coverage is intended to remain in force during the Insured’s entire lifetime, providing premiums are paid as specified in the policy. A whole life insurance policy can build cash value on a tax-deferred basis. Both the premiums to pay and the cash values that result are predetermined and found in the policy contract. The cash value is an amount of money available to the policy owner for policy loans or as the surrender value if the policy is canceled and returned to the company.

Universal Life: Considered “permanent insurance”, UL policies offer a valuable death benefit and provide the opportunity to build cash values that you can borrow, or withdraw. If your Universal Life (UL) policy is in force at the time of the insured’s death, policy proceeds will be paid in accordance with the terms of the policy to the beneficiary. With certain limits, you can choose the premium you wish to pay and this determines how the policy values develop. UL is also an “interest sensitive” product, which means that the interest rates credited to policy values will change over time.