Top 6 Tax Benefits of Life Insurance:

- Life insurance premiums are paid with after-tax dollars: Because premiums are typically not a tax-deductible expense, taxes have usually been paid on these funds and they are able to GROW tax-free.

- Tax-deferred cash value accumulation: Growth of policy cash value in excess of the cost basis are typically income tax-deferred while they remain in the policy.

- FiFO (First In First Out) tax-free distribution: For Non-Modified Endowment Life policies, cash can be withdrawn from the policy tax-free up to the adjusted cost basis.

- Tax-free death benefit: IRC Section 101(a) provides that death benefits of life insurance are income tax free when paid to the policy beneficiary.

- Not subject to 3.8% add-on tax for “passive” investment income under the Affordable Care Act (ACA).

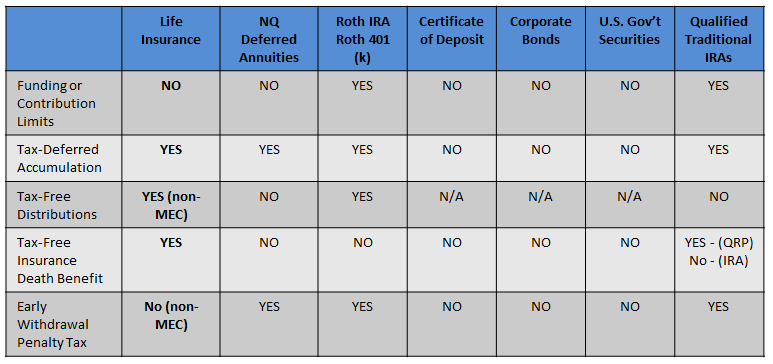

- No deposit limits: There are no restrictions on how much can be placed in a policy versus Qualified Retirement Plan/IRA Limits (see chart below).